Where are you in your customers' P&L?

also titled "Do robots dream of electric COGS".

I'll keep this one short. I hope. This week's rant comes after years of working on B2B software. If you're building or investing in B2B software, hear me out. The 3 biggest pitfalls I've seen in B2B software companies in the last 10 years are:

- Lack of awareness of where the product fits in customers' P&L.

- Over-complicated pricing structures.

- Misalignment of incentives (product doesn't add enough value to the stakeholder paying the bill).

I've talked about the 3rd one in this humble blog. Today I'll talk about the 1st one.

I'm seeing more and more B2B software companies not ask themselves the question: where do they fit in their customers' P&L. You'd think that's crazy because the checks come from somewhere. Still, not enough companies internally ask themselves where the checks actually come from.

So please do, and if you're an investor, ask your portfolio companies to do it. I guarantee you that an honest conversation about it will uncover critical aspects of your role in your customers' success. I see 2 ways of going about it, complementary to one another:

Whose budget is it coming from

Are you part of their marketing budget? Product? Engineering? Sales? Marketing and product?

This one is a little hard. Depending on the type of product you're building, it doesn't necessarily have to be a single team or department's budget, and sometimes it's not clear. Salesforce is an obvious one: it's usually in the Sales/Go-to-market team's budget unless they represent fringe value to adjacent teams.

This one is also that'll be slightly different for every customer. They should all be very similar, though, and you have to have an internal approximation of where you fit in that equation.

Why? This very much directly tells you where the checks are coming from. Your software is eating into a stakeholder's budget to execute a company function and the value you provide should be completely aligned with that.

It also tells you how fickle that budget will be. Notoriously, in times of skinny cows, one of the first budgets to be cut is marketing. If you're there, you need to increase your chances of staying and the only way to do that is by being as essential as possible.

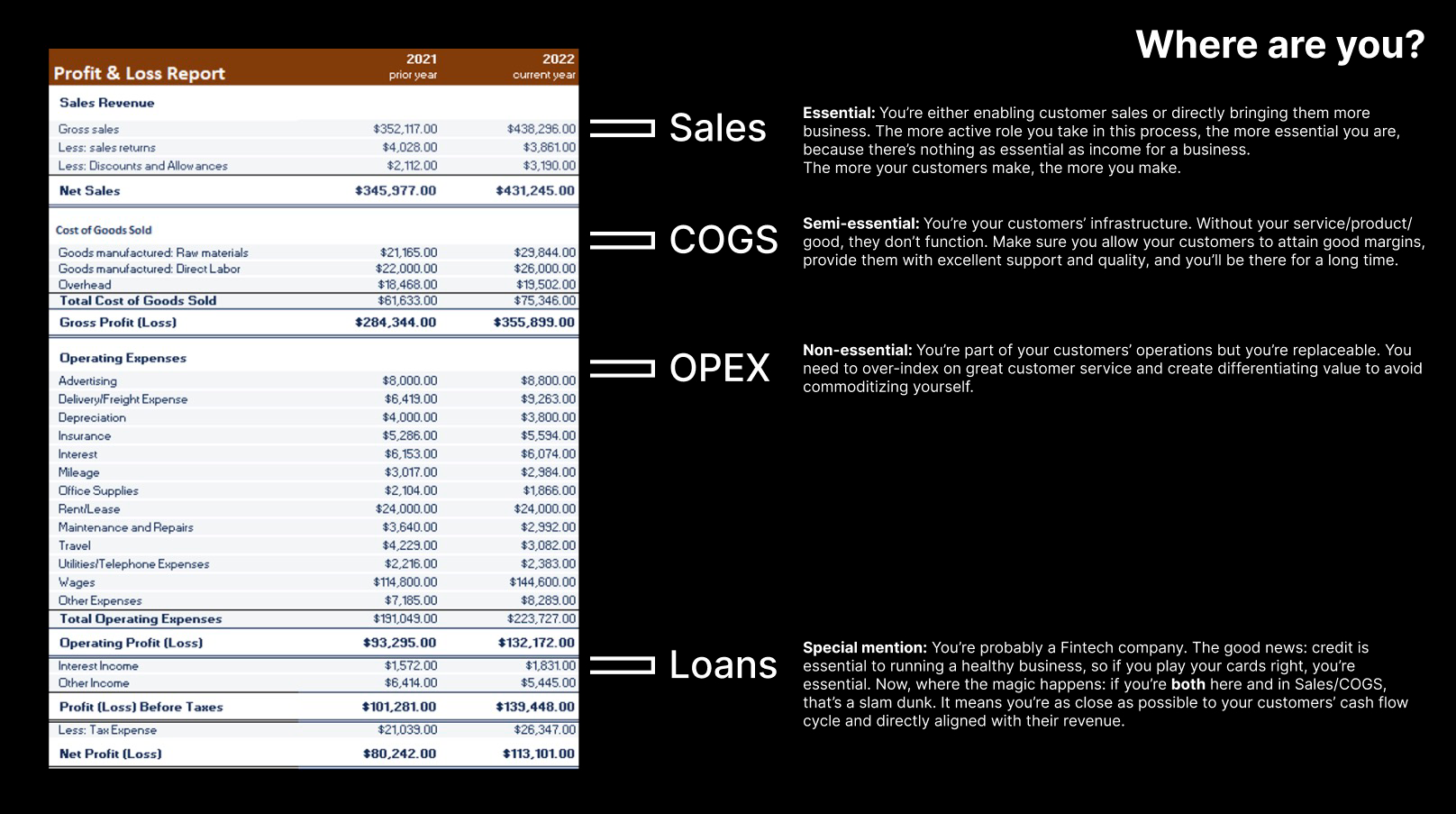

Where in the P&L are you: revenue, COGS, OPEX, ...

This one is easier to determine and once you do, you're going to wish you had had this conversation with your team years ago. When thinking about a project or company financially, before investing or working on something, it is one of the first things I ask myself (and I ask of founders).

Sales: You're essential. You’re either enabling customer sales or directly bringing them more business. The more active role you take in this process, the more essential you are, because there’s nothing as essential as income for a business. The more your customers make, the more you make.

COGS: You’re your customers’ infrastructure. Without your service/product/good, they don’t function. Make sure you allow your customers to attain good margins, and provide them with excellent support and quality, and you’ll be there for a long time.

OPEX: You’re part of your customers’ operations but you’re replaceable. You need to over-index on great customer service and create differentiating value to avoid commoditizing yourself.

Loans: You’re probably a Fintech company. The good news: credit is essential to running a healthy business, so if you play your cards right, you’re essential. Now, where the magic happens: if you’re both here and in Sales/COGS, that’s a slam dunk. It means you’re as close as possible to your customers’ cash flow cycle and directly aligned with their revenue.

In conclusion, knowing where you fit in the structure above tells you how essential you are to your customers, how replaceable, and how

I love working on essential problems, and I love working on direct revenue enablers. It sets you up for a growth mindset from day 1 and you're always directly aligned with your customers' incentives and interests.

I also love businesses that situate themselves in COGS. They're very much infrastructural in nature, hard to build, and complex problem spaces. You just need to be careful and take care of your customers' margins. If the margins are affected, you're the first one out. (Tangentially, I wish more companies would venture into honest dialog with their customers about how much they should charge them. Honesty drives growth).

A very special mention to my fintech friends. There are 2 ways of situating yourself in the world of credit: by strictly being your customers' loan provider or by enabling their cash flow cycle. The future is in the latter. An incredible chunk of the global economy would be smoother if more companies had access to easier/cheaper cash flow buffers.

Now here's where the slam dunk comes: if you can situate yourself as both a cash flow enabler and take an active role in getting your customers more business, you have an absolute unit of an opportunity. The value over time is exponential.

End of rant.